"Got Budget?” If you do, then you know exactly where your money goes each month, but if not, this post will share some insight into the age-old question: Where DOES all of my money go? According to the United States Bureau of Labor and Statistics, the average annual income and the average annual personal expenditures in the United States for 2017 and 2018 were as follows:

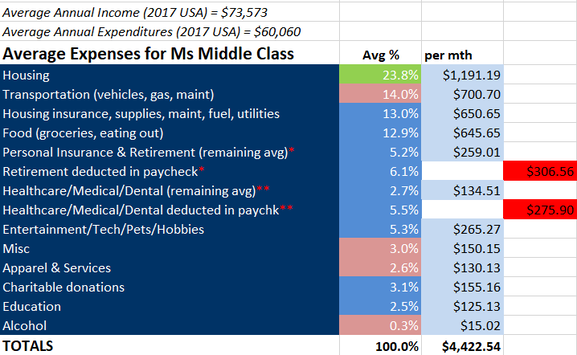

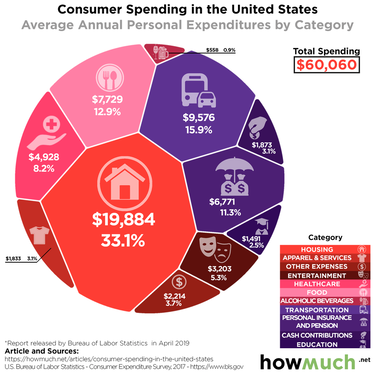

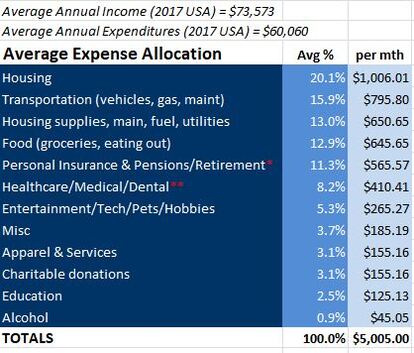

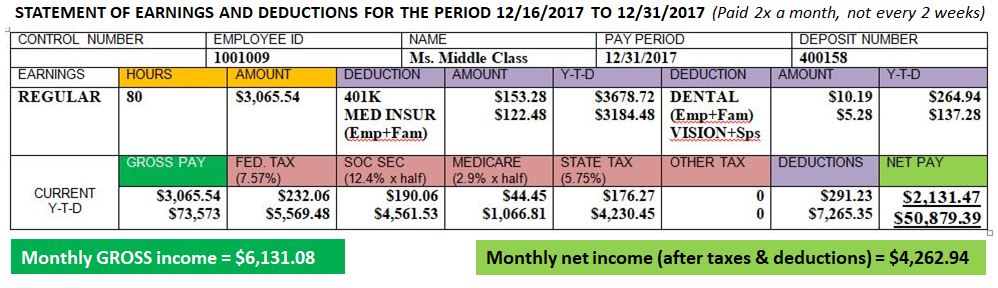

Sounds pretty good, right? Well, read on to see how it all turns out for Ms Middle Class and her family. For our example, we’re going to consider the 2017 data, because the graphic below from howmuch.net is available for that year but not for 2018. Based on the allocations of the 2017 average annual expenditures of $60,060, the monthly allocation would total $5,005 shown in the table below. The real view into this information and "where the money goes" happens when we look at a "real" example. Let's use this sample paystub below for our earner called Ms. Middle Class. The paystub represents the last paycheck for the year, so it not only includes information about the last pay period but also the totals for the year. This person gets paid twice a month, so after withholding taxes (married, filing jointly) and deductions (health and retirement), their monthly net income is $4,262.94. Using the 2017 US statistical data percentages & amounts from above, we've updated the allocation table to be more specific for Ms. Middle Class. Because she deducted money for retirement and for medical/dental/vision insurance from her pay already, you’ll see in her allocations here that those amounts (in red) are taken out so that they're not "expensed" twice. Also, since her housing costs are higher than the average, we’ve adjusted the percentages (green = increase and pink = decrease), while still keeping 2017 average expense allocations at 100%.  As I’m writing this, I’m actually doing the calculations, and I knew it was going to be close, but I was hoping that she wouldn’t be in the red! Unfortunately, you may have noticed that her monthly net pay is lower than her monthly expenses.

I’m actually feeling a little nauseous from the surprise/shock, and it’s not even real… but for so many, it IS real. Have you ever been there? Just hoping that there’s not “more month than money”? Don’t lose hope! There are things that Ms. Middle Class can do to get things back on track. But before reading further, what ideas do you have for her so that she at least balances out to zero? Without knowing her family's situation and what their current lifestyle and detailed expenses are, it's difficult to make personalized recommendations, which is what a Personal Finance coach does. Recommendations given to the family would be customized for them and their situation. In this sample case and for anyone who has “more month than money”, I always recommend 3 basic things:

Without knowing specifics about Ms. Middle Class and her family, here are some things I would suggest based on what I could see from her numbers above:

Just by doing the things mentioned above, this family could recoup the $160 that they need to break even, which definitely takes some of the stress off, BUT THERE ARE STILL MANY THINGS THAT CAN BE DONE with regard to increasing income so that they could make real forward progress. And that's the point, right?! Bottom line is, if you don't know where you're money is going each week/month/year, then you're losing ground. You CAN get back on track with some planning, focus, and determination. First thing is getting a budget together and allowing it to guide your spending. Please know that YOU are in control (or you and your spouse). This is not a straight-jacket. You create the budget with freedom and creativity based on the income and expenses you are living with. This is often eye-opening! What will YOU be able to do with a budget?

A personal finance coach can help fasttrack you to understanding what steps to take and in what order to get things moving in a forward direction. If you’d like to discuss your own situation, please reach out to me for a complimentary 30 minute consultation. References: https://www.bls.gov/news.release/cesan.nr0.htm https://howmuch.net/articles/consumer-spending-in-the-united-states If you'd like a copy of my SIMPLE BUDGET, contact me here and write "Simple Budget" in the Comment section of that form, and I'll email it to you. I sure have, and although it may seem like you’re the only one sometimes, I think that most people have experienced this.

I’m starting the year off with this post, because it applies not just to finances but all of life, and I want to encourage all of us to step out boldly this year instead of hesitating due to fear. When we hesitate, we have a sense of control because we’re still able to pull back. We’re able to pull back from the edge of the cliff, from the unknown, from looking stupid, from making a mistake, from failure… I have done this SO many times in my life. However, by hesitating and not making a commitment, we’re also not able to move forward. We’re stuck getting the same thing we’ve always gotten… NOT fully living. “If you always do what you’ve always done, you’ll always get what you’ve always got.” ~ Henry Ford Can we agree that when we take initiative and act with commitment and purpose, all sorts of things can occur that would never otherwise have occurred? Meetings with people, new relationships, material resources, increased self-respect and motivation, and new ideas for the future. Even if we fail, we learn and move forward, but hesitating and not taking action causes stagnation. So the only thing that stands in our way of moving forward is us -- our own hesitancy and fear. And if you’re not facing fear, you’re not growing. “A ship is safe in harbor, but that’s not what ships are for.” ~ William Shedd Consider the quote by American naturalist John Burroughs, “Leap, and the net will appear.” I love this quote, and when I first saw it during a coaching class I was taking, it hit me powerfully! I pondered whether there was recklessness involved, but honestly, that’s the point. While we don’t want to be reckless, if we shy away from any risk, we can become paralyzed by what we tell ourselves, by our fear, etc... I know; I’ve been there. I tend to want so much information before doing something that I’ve missed a lot because of not stepping out boldly. And what’s a bit ironic is that some of the things that I was hesitating on and that I was thinking were bold and risky, in hindsight really weren’t. I had built them up in my head to be more fearful than they ever really were. Can I get an Amen?! “For God has not given us a spirit of fear and timidity, but of power, love, and self-discipline.” 2 Timothy 1:7 What I’ve learned and am still learning is that “leaping” includes stepping into the unknown and scary over and over again, but it gets easier when you experience growth and forward progress from each leap. You begin to trust your own instincts more and earlier. “You gain strength, courage, and confidence by every experience in which you really stop to look fear in the face. You must do the thing which you think you cannot do.” ~ Eleanor Roosevelt Even the crashes reveal new learning and new pathways along our journey, as we become a new and better version of ourselves. No one is perfect. We’re all a work in progress. If we are willing to be open to seeing the challenges and “failures” as keys to learning and growing, we can keep moving forward. The main point is: What we learn and who we become by taking the risk and “leaping” is the achievement itself. The results don’t matter; it’s the act of leaping and the process of becoming a better version of ourselves that is the payoff. “Whatever you can do, or dream you can, BEGIN IT; boldness has genius, power, and magic in it.” ~attributed to Goethe Question: What bold step (even if it’s small) will you commit to so that you can experience growth and forward progress? SCHEDULE A 30 minute COMPLIMENTARY COACHING CALL: As a certified Personal Finance Coach, I'd love to help you amplify your personal finance effectiveness! Schedule a 30 minute complimentary consultation with Kathleen. MakeIt Money from CNBC interviewed self-made millionaires, who shared top ways to make this year your best financial year yet.

1. “Be true to yourself (and the money will follow).” - Itzik Levy Connect your goals with your personal values. (Click here for an exercise to determine your core values.) Itzik says, “This is more than a way of life — it’s the best way to build a successful business. Consumers respond to authenticity and are increasingly good at detecting false promises and brand personalities. Own your personality, reflect it in your brand and encourage your team and clients to bring their real selves to the table.” 2. “Only Spend a Percentage of Your Income.” - Lin Sun You can still enjoy your life while managing your resources. Software can help with this like YNAB, EveryDollar, or even an Excel spreadsheet to manage your budget, Mint or Quicken to manage personal accounts, and QuickBooks or XERO to track business profit and loss, balance sheets, financial trends, and budgets. A regular review (monthly) of your finances (with significant other) is critical for visibility, transparency, and accountability. 3. “Create a financial tracking system.” - Dennis Najjar By getting a system in place to predict the next 12 months financially, you will be able to see things much more clearly than if you’re only budgeting 1 month at a time. Granted – this takes more work than budgeting just 1 month, but most of the expenses carry over month to month anyway, so you’re looking for things that would be different, like a large purchase, a vacation, house or car repairs (roof or tires) that you know you’ll need. These you can budget for throughout the year using a “sinking fund” approach, where you take the amount needed and dividing it up into x number of amounts based on how many months you have until that purchase. Dennis recommends that you “set up weekly or monthly checkpoint intervals, where you review your numbers to see how you’re tracking against your prediction”. And that you add ”into your budgets opportunities to pivot should the numbers perform as, better, or worse than expected — so you don’t reach year-end completely off the mark. It’s not rocket science; just commitment to process, procedure, and accountability.” 4. “Prepare for the four D’s.” —Gail Corder Fischer Gail says that the biggest threats to your financial future are debt, death, divorce, and bad decisions. She recommends that you do the following:

5. “Put your money to work.” – Grant Cardone You want your money to appreciate and to provide consistent cash flow. Find investments that will do just that. 6. “Invest in Real Estate” - Daniel Lesniak Daniel says, “Find ways to get higher returns for your investments by networking or looking for the right deals. Even a few percentage points add up. The difference between 10% and 15% returns might not seem like much in the short term, but over 30 years, that’s the difference between doubling your money four or seven times. Investing in real estate is a great way to do this 7. “Invest in Yourself.” – Barbara Corcoran Whether wellness-related like a massage or an afternoon off with a friend OR business-related like building skills to enhance your ability at a job or your marketability, don’t forget about you. 8. “Give More.” - Kuda Biza Kuda says, “The secret to living your fullest life is giving. While there is peace in having financial security and comfort, neither means anything unless you help others and have gratitude.” |

AuthorAs a certified Personal Finance coach (and homeschooler of 15 years), Kathleen has worked with people of all ages, but her passion is to help kids/teens/young adults take control of their finances early, learn entrepreneurial skills, generate multiple income streams, and get on a path to Financial Hope & Freedom so they can live into their passions and purpose. (Free Webinar on how to Empower Money Smart Kids with Financial Literacy & Entrepreneurial Skills) Archives

January 2023

Categories

All

|

Copyright 2023 by Katalytic, LLC

RSS Feed

RSS Feed