|

"A man spent hours watching a butterfly struggling to emerge from its cocoon. It managed to make a small hole, but its body was too large to get through it. After a long struggle, it appeared to be exhausted and remained absolutely still.

The man decided to help the butterfly and, with a pair of scissors, he cut open the cocoon, thus releasing the butterfly. However, the butterfly’s body was very small and wrinkled and its wings were all crumpled. The man continued to watch, hoping that, at any moment, the butterfly would open its wings and fly away. Nothing happened; in fact, the butterfly spent the rest of its brief life dragging around its shrunken body and shrivelled wings, incapable of flight." ~Unknown What the man did, with the best of intentions, actually harmed the butterfly's chance to thrive. The man failed to understand that squeezing thru the tight cocoon would allow the blood to push into the butterfly's wings, allowing it to fly. Do we sometimes unwittingly do the same for our children? Do we step in and pave the road before them or keep them from doing something they'd like to try because we don't think it's a good fit? Or do we allow them to struggle and take the time to walk roads we wouldn't necessarily choose for them... all with the opportunity to grow, maybe fail, but hopefully figure out what's right for them? Do we want them to lead authentic lives that are just for them? Only they know how they feel about the activities and experiences they take on... about the roads they walk and the struggles they have. Some may leave them feeling weak, while others may leave them feeling strong. But all should give them a better idea of who they are. Let's give our kids the gift of space & time, to the best of our abilities, to determine the life God has for them to thrive in. Diversification. I’ve been teaching personal finance to teens, college-aged, and older adults for over a decade, and as a certified personal finance coach, the concept of diversification is one that comes up every time.

What do I mean by diversification? Well, for the focus of this article, I’ll be sharing the importance of having multiple income streams. I envision each income stream as a different color - providing opportunities to make your life fuller, richer, and more colorful. Why is diversification important? Well, we all saw what happened during Covid regarding many people losing their primary and only source of income. And while the loss of income due to Covid policies was something unprecedented and far-reaching, losing your primary source of income happens to individuals all the time. How will multiple income streams benefit you? Consider that multiple income streams can do the following:

Of course, tightening your budget, reducing unnecessary expenses, and seeking a pay raise can help bring in more income, but the focus is not just to increase income but to add a variety of income streams to protect yourself. Start with your interests So here are a few high-level suggestions for additional income streams:

I am personally familiar with all but the last two and know them to be viable sources of income. My husband and I have been investing since our late 20s. My parents had multiple rental properties. In addition to having my own business empowering companies with specific tech solutions, another area of deep interest for me is in natural health and wellness, which I started exploring and then diving into almost 30 years ago. That led me to start a network marketing business in the health & wellness area. Be discerning and evaluate opportunities When evaluating any opportunity, it’s wise to be discerning. As an example, when considering a network marketing business, the following are critical for success 1) a company of integrity, 2) quality products, 3) a strong compensation plan for everyone, and 4) a mission of empowerment. While some may not agree, if these attributes are present, I truly see network marketing as a viable business model for generating income. After evaluating with discernment, I started with a network marketing company in the area of health & wellness in 1997 and another on the ground-floor in 2021. Although initially you won’t know positively if it will be a great opportunity, just do your due diligence and if it seems a good fit, dive in and see where it takes you. You’re in control to pivot as needed. So, consider a few ideas that are a good fit for additional income streams for you, and get started. Diversification can color your life and income richly. And while you’re not going to get rich overnight, it does tend to add up with hard work. And then with wise investing and compound interest, you can create another income stream --> investment income, where your money will go to work for YOU. If you followed my Holiday Saving blog post from last year, you should be in great shape for holiday spending this year. But with COVID crushing so many financially, perhaps your Holiday spending fund got pilfered just so you could make ends meet.

Here are 5 tips to help give gifts for the holidays without going into debt (SAY NO TO DEBT!) 1. DIY GIFTS: I’m going to start with the no or very low cost gift ideas. If you’re like me, you love a great hand-written note. And if the card has been hand designed, even better. Remember that no one wants you to spend money you don’t have to please them. Break out of the “people pleaser” mindset. On the flip side, no one wants to see you showing up in all new clothes and then say you couldn’t get them a gift. If you really have no funds, use your creativity and ingenuity to brainstorm low or no cost gifts. Not as a cop out, but as a true gift. Use Facebook marketplace or freecycle to upscale something. Brainstorm with your friends – maybe you can help each other with DIY gifts. And if nothing else, a great hand-written note/poem may be the best gift of all. 2. BUDGET for 8 WEEKS: If you have the means, I suggest budgeting over October & November (maybe into December) for the holidays… that’s 8 weeks to save. If you can save $100 a week, you’d have $800 for the holidays. Can you do that? If you don’t need that much or you can’t save that much, then scale back. Even $50 a week (or $100 every 2 weeks) will yield $400. 3. WRITE IT DOWN: Know what you’re going to spend your money on – have a plan. If you have $500, how much is going towards gifts, food, travel, décor, charitable giving? Be specific. If you have 5 people you will be purchasing for, name them and write an amount next to their name (within your budget) and then stick to that. This plan will help keep you from going into debt. 4. USE APPS & COUPONS: Search for promos, coupons, sales. There are even apps to help you find deals (Honey) and give cash back when you shop online. to find deals when shopping online like Ibotta, Ebates/Rakuten, Shopkick, Wkibuy and Mr. Rebates. 5. “LOCK UP” CREDIT CARD: Use your debit card to shop online or at in-person stores. Could even use CASH if you’re shopping in-person. I know it’s a novel concept! Either way you’ll be more likely to stick to your budget and to not start adding things for yourself or things you don’t really need. Here’s to you as you prepare your hearts for the holiday season coming soon. First of all, what is a recession? The National Bureau of Economic Research defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” (Investopedia)

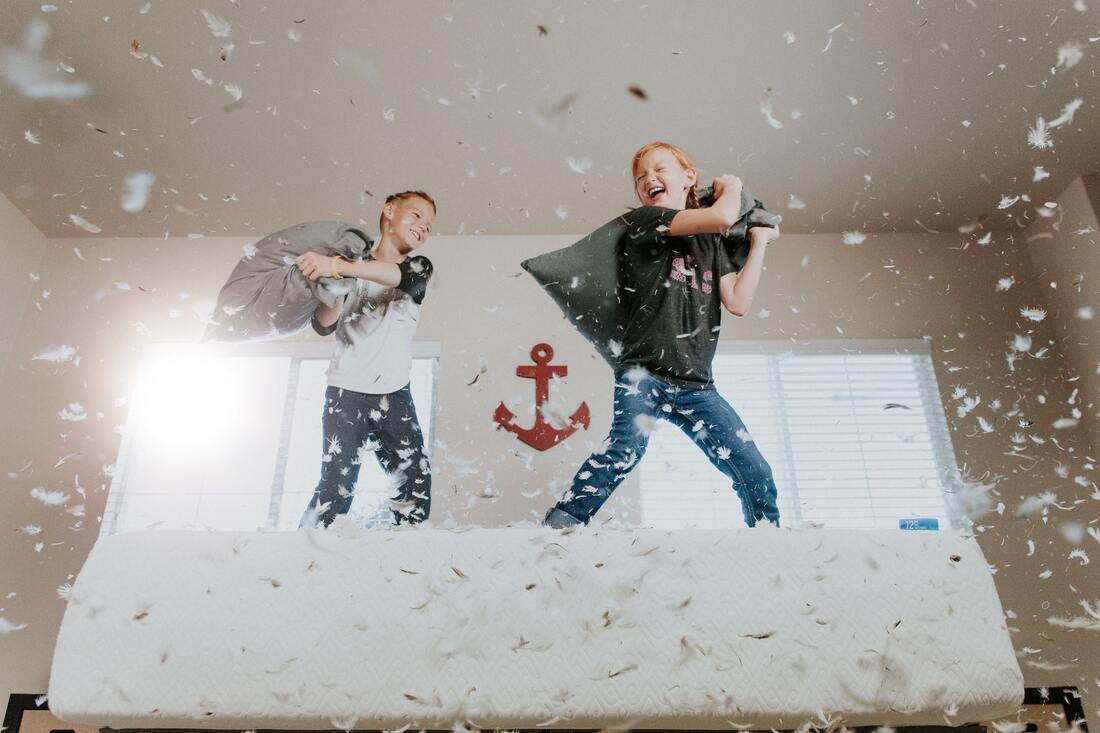

Gita Gopinath, the IMF’s chief economist, said in the latest World Economic Outlook report, “It is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.” What is the average American to do? FREAK OUT?! Would you agree that it makes more sense to focus your time & energy on your own personal finance picture than give into fear? Because recession or not, a firm financial foundation will help you fend off a layoff, medical emergency, or recession at any time. So rather than spending time watching / reading the news for hours, which is enough to bring anyone down, why not invest that time into establishing healthy financial habits: living on a budget, paying off debt, saving for emergencies, investing toward retirement, and helping others. I know it sounds like no fun, but the peace that you’ll experience will be worth it! Basically, preparing for a recession is just adopting basic healthy financial habits. BUDGET – A budget is a snapshot of your financial health and helps you plan for where every dollar that you take in will go. You are in control – you still are, even if your income has decreased. For your first cut at budgeting, you can look at taking your monthly income (or biweekly income) and splitting it up, as some recommend, into 50% towards essentials (food, housing, utilities, transportation, and minimum credit card / loan payments), 30% towards non-essentials (dining out, clothing, outings), and 20% toward savings. If you’re suffering a job loss, you may not be able to put anything toward non-essentials or savings, but how can you budget for the essentials? This is where you will want to get creative and look for ways to cut expenses and increase income. To get to a bare bones budget, you’ll need to cut non-essentials and reduce as many essentials as possible. You can cut some expenses entirely (cable, subscriptions, sell extra vehicle) or partially (call utilities, credit card companies, insurance companies, etc… and see if they’ll reduce charges or interest rates…). You can change your spending habits, use cash or cash-less envelopes instead of credit cards, plan meals so there’s less waste, use coupons, stop purchasing online, etc... You can look at increasing income by selling stuff on Facebook marketplace or Amazon marketplace, selling clothing on Poshmark or Mercari, helping others mow their lawn, mulch their beds, fix their cars, do freelance work for a friend or family member who still has their job, etc… Here’s also where you’ll want to evaluate how you will use your stimulus check, assuming that you are getting one. For those who are really suffering financially, meeting your essential needs first is critical. If you have anything left, then perhaps adding to your emergency fund as a cushion for next month. DEBT – If you have been working a debt snowball or debt avalanche and have a stable job, then you should consider staying the course with your debt reduction plan. However, if you’ve lost your job or hours, or have any kind of job insecurity, it may be wise to move any extra debt payments you’ve been making to your expenses or emergency fund. Of course, you’ll want to make sure you are still making your minimum payments on housing, loans, and credit card debt, so you don’t end up with other problems to deal with later. Once you are back on stable financial and footing with your job, you can resume your debt reduction with a vengeance, and put it behind you forever. EMERGENCY FUND – this goes hand in hand with your budget. Even if you have 6 months of expenses set aside for emergencies, if you’re out of work, your emergency fund will start getting depleted. That’s okay, since that’s what it’s for, but in our current economic landscape you may want to cut way back on your normal expenses, so your emergency fund lasts longer and doesn’t take as great a hit. Likewise, if you barely have an emergency fund, you are going to want to get to a bare bones budget and see how far you can stretch what you do have. Once you’ve recovered from all the repercussions of the coronavirus and financial hardship, my recommendation is to aggressively finish paying off your debt and to get your emergency fund ramped up. Set a goal for your emergency fund of at least 3 months’ worth of expenses to start. If you determine 3 months of expenses to be $9,000, for example, consider moving $1000 a month into the fund or $500 every 2 weeks. That will get your emergency fund funded in 9 months. If that’s not practical, tighten your belt as much as you can and do everything in your power to get an emergency fund funded as quickly as possible, so you’re protected for future crises. INSURANCE – It may be difficult right now to make adjustments to current policies, but some insurance providers are offering credits, leniency, and assistance. Check with providers for each of your different type of insurance to determine what help they can give you. If you have your insurance premiums set up on automatic payments, you’ll want to revisit those and make adjustments accordingly. INVESTING – Whether you’re nearing retirement or not, if you’re constantly looking at your 401k or IRAs and anxious about it, my recommendation is talk to a financial investment advisor that you trust so he/she can help you understand your options and guide you in making wise investment decisions at this time. GIVING – Whether you can give some time, some of your skills/talents, or some resources, helping others always takes the focus off of our own fears and worries and changes our perspective a bit. Hopefully in spending time on your own personal family economy: your budget, debt reduction plan, emergency fund, insurance, and investments, as well as giving to others, much of your anxiety will be reduced and you will have set your family up to be as stable as possible for whatever comes with the national and global economy. Do we, as parents, tie our identity to what we do rather than who we are (our BEING). My old boss of a small leadership development consulting company would always say, “we are human beings, not human doings”. Wow! Talk about shifting the mindset of a DOer/FIXer (me)! Too often people think of themselves (and others) as “human doings” and thus attach any failed outcome to their own identity as a person and to their innate worth as a human being. This is something that each of us has to examine for ourselves to determine if we may need to shift our mindset. We also want to ensure that we don’t inflict that paradigm on our kids. If we can help our kids separate how well they do something from their identity, it will free up their energy to see failure as a key to the learning, growing, innovation process. [Here's a great list of positive words for helping you describe your child's behavior, character, or actions rather than their BEing.] Regarding chores and allowance … after giving your kids some basic guidance on their work task or on their finances, be patient and give them some autonomy so they can work through things themselves. Allow them to experiment and falter or shine so they can test their abilities and learn. “If you’re not failing, you’re not growing.” – H. Stanley Judd With money, allow them to decide what they’d like to spend their “Spendable” jar cash on. Give them the freedom to exercise “opportunity cost”, so they can see firsthand that by using their money on something now means they won’t have that money later for something they may consider more important. With chores, after showing them how to accomplish a task, like washing the kitchen floor, for example, allow them to do it “their way” and experiment on how to accomplish the task in a way that gets the job done and works well for them. When my daughter Elissa was young, she wanted to clean the laminate kitchen floor like Cinderella, so she would get a rag and a cleaning spray and sing “Sing, sweet Nightingale” while cleaning (so cute!). That slow methodical approach to cleaning the floor didn’t last because it took too long, but she figured that out for herself and changed how she did it. By giving our kids opportunities to make their own decisions and the opportunity to “fail” and overcome disappointment, they’ll not only learn, but they’ll realize that they’re not helpless. This encourages competence, independence, and resilience in the face of frustration. And as they develop competence in jobs that they take on and in the money that they manage, they’ll do a better and better job at it and be able to take on greater responsibilities with confidence. Luke 16:10 Intentional parenting takes work, but there’s a payoff. Proverbs 22:6 says, “Train up a child in the way he should go, and when he is old he will not depart from it.” Being paid for hard work, developing a spirit of contentment rather than entitlement, and developing accountability, independence, and confidence will all stick with our kids the rest of their lives. Learning how to be responsible for some of their financial decisions from a young age will increase their financial know-how, so when they enter adulthood they hopefully will be wise enough not to succumb to all the financial temptations that our culture has for them.

Parents – what an awesome privilege we have to break the pattern of financial bondage that is “normal” in America, not only by you yourselves getting on the road to financial health, but in teaching your kids how to become financially savvy from a young age, so they never have to experience what is so typical in our society. Helping parents raise financially wise kids is one of the main missions of my business and my life! Why? Because in helping adults for the past 10 years get their own personal finances in order, I’ve seen the devastation that financial bondage and turmoil can create in families. But I’ve also worked with kids 7-18 and have helped set them up for financial health, hope, and freedom as they enter adulthood. Parents who help their kids develop personal finance know-how, especially when the money they receive is tied to work, can accomplish the following:

“We’re not trying to raise good kids. We’re trying to raise kids who become great adults.” Andy Andrews Here’s a summary of what our family did to help develop financial know-how in our kids. When our kids were 3 and 7 years old, my husband and I joined a parenting book group, reading one of Dr. Kevin Leman’s parenting books (Becoming the Parent God Wants You To Be). Among other takeaways, we latched onto the concepts of being intentional with chores and paying our children an allowance based on their age per week (we started at age 7). Yup! We thought that was a lot of money for a young child, but there was more to it. They didn’t get access to all of the money to do as they pleased; there was structure attached and purposeful lessons to be learned. Throughout the years, the girls had chores to do (typically a 15-20 minute chore each schoolday (since we homeschooled they did this right after Bible study and before breakfast)), and the allowance they received was kind of like a salary. Their money was broken up into 4 “buckets” (that’s what we called them, but you could use jars, envelopes, shoeboxes, etc… CLEAR is best). We started with cash but then moved to actual bank accounts because managing the cash was a bit cumbersome. Using cash would have been better because of the tactile sense and emotion attached to real money. We however managed all of the money via bank accounts and only used real money when the kids wanted to spend it. The 4 “buckets” that we used were as follows: The 4 “buckets” that we used were as follows:

GIVING – this account was used for charitable contributions and good stewardship to church, ministries that the girls were interested in, and for mission trips that they took. SPENDABLE - this account was used for things that Mom & Dad wouldn’t pay for. The kids learned GREAT lessons in patience, responsibility, opportunity cost (choosing priorities for their money), etc… We always called this "Spendable", but it was really a SAVE/SPEND account, because oftentimes they were saving for something specific. COLLEGE - this account was for the 30% that our kids had to pay for their college. At a state school of $28k a year, that’s $8,400/year for them. Even with the money saved in this bucket/account, this was quite an undertaking, yet they both still did it and came out of college debt free. Much more to share on this. LONG-TERM/CAR - this account was for the kids to buy their own car at age 21. We had told them from the beginning that we would match this fund UP TO $5000 when it came time to purchase their car. So when the oldest turned 21, she made sure her long-term savings had at least $5000, which then meant with our match, she had $10,000 to spend on a car. She bought a used 2002 Honda Accord and had a little work done on it all for under $6,000. She used this account to then help cover auto insurance, maintenance, vehicle taxes… The girls also had their own businesses as they got older, and they continued to split up their earnings into these 4 buckets (bank accounts). I mentored them on starting their businesses, and one business concept was so good that my younger daughter ran the business (with support from me) every summer for 3 summers from age 14 to 16. Each year, she took on more and more responsibility, which freed me up. I have lots of lessons about the skills and character development gained with this endeavor and all of the entrepreneurial endeavors. There is SOOOOO much more to this story, including the confidence, responsibility, reliability, generosity, and freedom the girls gained through all of this experience. I encourage parents to be intentional about this training with their own kids so they become financially wise and savvy from a young age. By teaching them early, you’ll instill good financial habits that they’ll take with them into life so they can avoid the financial pitfalls that so many fall into. ************************** JOIN OUR FACEBOOK GROUP: To find out more and to join the conversations, please join our Facebook Group called Kataltyic Kids https://www.facebook.com/groups/KatalyticKids where we talk more about ways to raise financially wise kids from a young age and develop Godly character as part of that. YOUTUBE / PODCAST: Also, check out my Youtube channel to see interviews with other parents on finances and entrepreneurship with their kids, interviews with my own adult daughters, and input from some of the “experts” out there.

Todd Baldwin and his wife are intentional about their finances, and have done incredibly well for themselves. When I read this article about this young millennial millionaire couple’s budget and cashflow, I was inspired to share it. Not because others need to do exactly what they're doing, but because it demonstrates what is possible when you have a strong WHY, have no consumer debt, have an emergency fund, and have some solid financial knowledge to work from. Being frugal and not being flashy also played a large role in their success.

I've highlighted the key points from this article below and also make some recommendations on a few things that they might consider. Todd Baldwin has always wanted to make a lot of money... WHY: He was raised by single mom who struggled working 4 jobs to feed 3 kids. She was worried all the time about money, and he saw it and felt it. He didn’t want to feel that financial stress when he grew up. WORK YOUNG: He started working at age 12, shoveling manure for $3 an hour, and when he looked at his $6 in quarters earned, it was more money than he’d ever seen. He was excited by the thought of making millions! REAL ESTATE INVESTING: He started investing in real estate at age 23. By age 25 his net worth exceeded $1 million, thanks to savvy real estate investing with his wife. Their $4.4 million in real estate is supported by $3.1 million loans, which means they have roughly 30% equity. Their loan payments are currently covered in full by tenant rent, so as long as there are tenants and their lenders don’t call their notes, they’re in great shape. FRUGALITY RULES: This couple lives well below their means, and are able to bank the wife’s annual 6-figure paycheck from her 9-5 job. They are not showy: he actually wears a $12 rubber wedding ring, and they only own 1 car, a 2009 Ford Focus. The also make sacrifices to get ahead: they have roommates and don't take vacations or have luxuries. They even have a side-hustle as "secret shoppers", which allows them to get free meals, groceries, entertainment, car maintenance, and sometimes gas! And here's how he and his wife have done it... INCOME: $615k gross/yr --> $305k net/yr ** 80% is reinvested into more real estate

MONTHLY BUDGET:

SAVINGS:

Really, this couple is doing an incredible job of living life frugally and intentionally in order to invest and create a rich financial future. They’ve sacrificed a lot of fun that others their age have taken advantage of, but the article mentions that they plan to rectify that at some point. The article doesn't share, however, if and how they are using some of the resources that God has blessed them with to bless others. (Matt 6:19-21) They seem like a couple that would do that. :) A few recommendations for them to consider... MY FINANCIAL RECOMMENDATIONS:

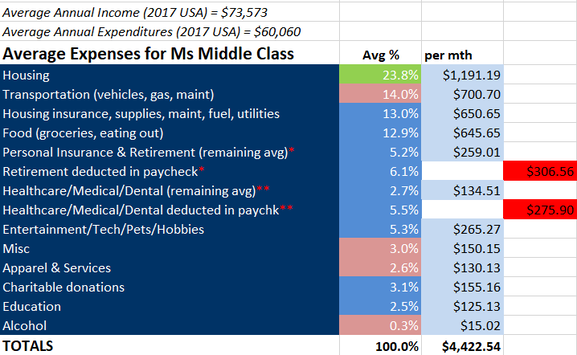

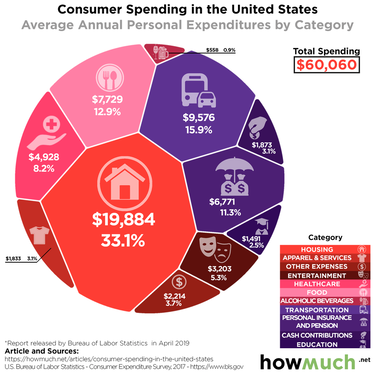

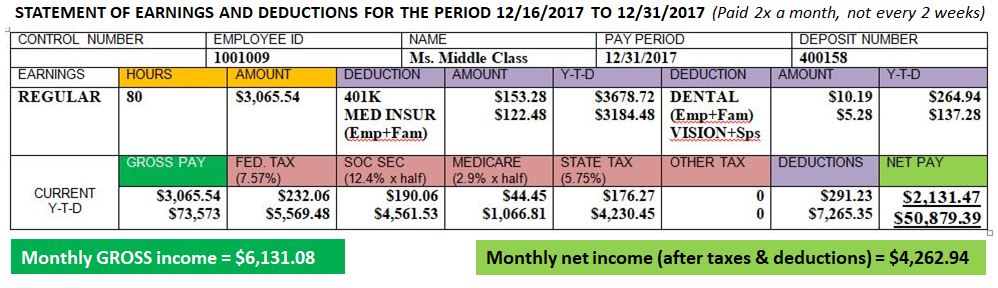

"Got Budget?” If you do, then you know exactly where your money goes each month, but if not, this post will share some insight into the age-old question: Where DOES all of my money go? According to the United States Bureau of Labor and Statistics, the average annual income and the average annual personal expenditures in the United States for 2017 and 2018 were as follows:

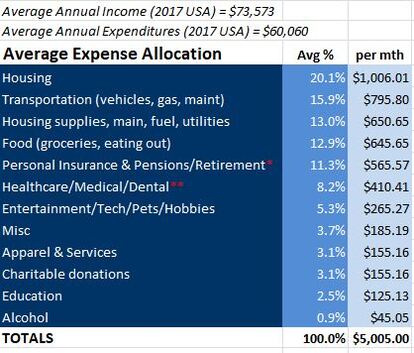

Sounds pretty good, right? Well, read on to see how it all turns out for Ms Middle Class and her family. For our example, we’re going to consider the 2017 data, because the graphic below from howmuch.net is available for that year but not for 2018. Based on the allocations of the 2017 average annual expenditures of $60,060, the monthly allocation would total $5,005 shown in the table below. The real view into this information and "where the money goes" happens when we look at a "real" example. Let's use this sample paystub below for our earner called Ms. Middle Class. The paystub represents the last paycheck for the year, so it not only includes information about the last pay period but also the totals for the year. This person gets paid twice a month, so after withholding taxes (married, filing jointly) and deductions (health and retirement), their monthly net income is $4,262.94. Using the 2017 US statistical data percentages & amounts from above, we've updated the allocation table to be more specific for Ms. Middle Class. Because she deducted money for retirement and for medical/dental/vision insurance from her pay already, you’ll see in her allocations here that those amounts (in red) are taken out so that they're not "expensed" twice. Also, since her housing costs are higher than the average, we’ve adjusted the percentages (green = increase and pink = decrease), while still keeping 2017 average expense allocations at 100%.  As I’m writing this, I’m actually doing the calculations, and I knew it was going to be close, but I was hoping that she wouldn’t be in the red! Unfortunately, you may have noticed that her monthly net pay is lower than her monthly expenses.

I’m actually feeling a little nauseous from the surprise/shock, and it’s not even real… but for so many, it IS real. Have you ever been there? Just hoping that there’s not “more month than money”? Don’t lose hope! There are things that Ms. Middle Class can do to get things back on track. But before reading further, what ideas do you have for her so that she at least balances out to zero? Without knowing her family's situation and what their current lifestyle and detailed expenses are, it's difficult to make personalized recommendations, which is what a Personal Finance coach does. Recommendations given to the family would be customized for them and their situation. In this sample case and for anyone who has “more month than money”, I always recommend 3 basic things:

Without knowing specifics about Ms. Middle Class and her family, here are some things I would suggest based on what I could see from her numbers above:

Just by doing the things mentioned above, this family could recoup the $160 that they need to break even, which definitely takes some of the stress off, BUT THERE ARE STILL MANY THINGS THAT CAN BE DONE with regard to increasing income so that they could make real forward progress. And that's the point, right?! Bottom line is, if you don't know where you're money is going each week/month/year, then you're losing ground. You CAN get back on track with some planning, focus, and determination. First thing is getting a budget together and allowing it to guide your spending. Please know that YOU are in control (or you and your spouse). This is not a straight-jacket. You create the budget with freedom and creativity based on the income and expenses you are living with. This is often eye-opening! What will YOU be able to do with a budget?

A personal finance coach can help fasttrack you to understanding what steps to take and in what order to get things moving in a forward direction. If you’d like to discuss your own situation, please reach out to me for a complimentary 30 minute consultation. References: https://www.bls.gov/news.release/cesan.nr0.htm https://howmuch.net/articles/consumer-spending-in-the-united-states If you'd like a copy of my SIMPLE BUDGET, contact me here and write "Simple Budget" in the Comment section of that form, and I'll email it to you. |

AuthorAs a certified Personal Finance coach (and homeschooler of 15 years), Kathleen has worked with people of all ages, but her passion is to help kids/teens/young adults take control of their finances early, learn entrepreneurial skills, generate multiple income streams, and get on a path to Financial Hope & Freedom so they can live into their passions and purpose. (Free Webinar on how to Empower Money Smart Kids with Financial Literacy & Entrepreneurial Skills) Archives

January 2023

Categories

All

|

Copyright 2023 by Katalytic, LLC

RSS Feed

RSS Feed