So, it’s the end of December and you’re thinking about how you wished you hadn't spent so much on the holidays this year so that you wouldn’t have holiday debt to pay off in the new year. Well, what if there was an easy way to roll into November next year with enough money for your holiday shopping and plans? Follow these steps and you’ll find your holiday expenditures are less stressful and maybe even joyful! Our family started doing about 10 years ago, and it really works! Step 1 – Create a Holiday Budget for the new year For those with discretionary income, the Better Business Bureau and Clearpoint Credit Counseling Solutions recommend a holiday spending budget of 1.5% of your gross income. Their Holiday Budget Planner uses the gross income that you enter and calculates holiday spending broken into categories like Gifts, Parties, Travel, Food, and Donations, which you can adjust as needed. See the example below using a gross income of $100k. Once you have the gross income entered, you can adjust category values as you see fit. (NOTE: Be aware that you'll first need to adjust a category down before you can adjust another up). Once you're satisfied with your adjustments, you can click NEXT and add more detail under each category, like who you’re buying for and how much you plan to spend on each person (you might want to budget for 1 extra person, just in case you forgot someone). This basically creates a mini-budget just for the holidays with a good amount of detail under each of the holiday categories. Give it a try and make adjustments as needed, OR create your own holiday budget using a percentage that you know will work for you. Then go on to Step 2. NOTE: Don’t forget about possible expenses like:

Step 2 – Save a small amount each pay period Having the money set aside when it comes time to doing your holiday shopping is key to avoiding debt for the holidays. To get started with this, you’ll want to divide the total Holiday Budget amount from above by the number of pay periods you have in the year. Using the Total Budget amount in our example above, consider these 3 common scenarios:

Step 3 – Set up a “Christmas Club” savings account Now you need somewhere to save that money. I recommend going online (or calling or in-person) and set up an additional savings account at your bank or credit union. Name it “Christmas Club” or something that reminds you of what you’re saving for. Then set up an automatic transfer from your main paycheck account to this “Christmas Club” account using the amounts and frequency you determined in Step 2, so that by the time you’d like to purchase gifts, food, etc… you’ll have most of the money in that savings account. In fact, you’ll have some money in the account all year long, so if you see something that would be perfect for Mom mid-year, and it’s at the budgeted price point, you can purchase it early with cash and joyfully check Mom off the gift list. Notice that I said “with cash”. You’ve done an incredible job setting aside this holiday money in a savings account so that you’ll have the money on hand to pay for the holidays. Avoid using a credit card or you’ll run into trouble. If you don’t follow my advice, and you do use a credit card, please please please stick to your budgeted amounts and then transfer that exact amount from your Christmas Club account to your checking account and send a payment to the credit card company right away. Do NOT wait for the credit card bill to arrive. Take care of it right away if you want everything to work smoothly. You can do it! And I'll be right there with you! Give it a try and let me know how it worked for you next year. NOTES:

Consider Joining my FB Group "Personal Finance Katalyst" for more personal finance tips for you and your family! Disclaimer: This blog post provides personal finance educational information, and it is not intended to provide legal, financial, or tax advice.

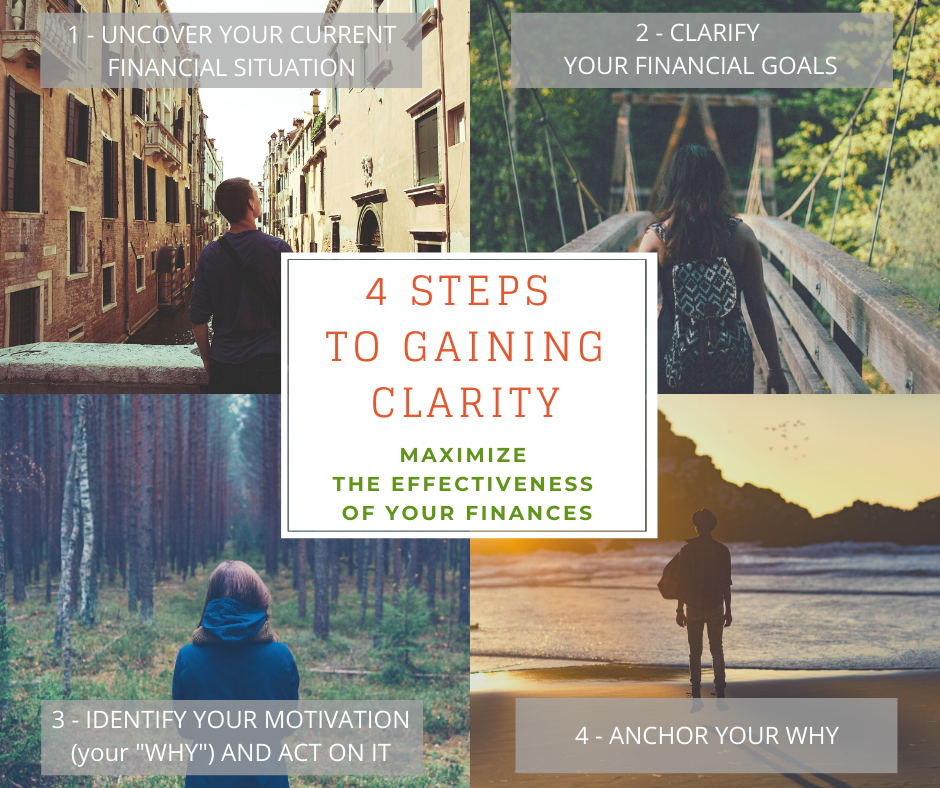

Have you ever been in a place where you keep getting the same old results and not getting much traction? Or felt like it just wasn’t worth the hard work to do something you wanted to do? Well, if you’re fed up with complacency, these 4 steps to gain clarity are for you!

“If you always do what you’ve always done, you’ll always get what you’ve always got.” Henry Ford You’ve heard that saying before, and I’ve been there myself and have witnessed this with others working on their personal finances… but what if there was a way to gain traction, find the motivation to put in the hard work, and get the results you’re after? This powerful 4 step “Gaining Clarity” exercise (which has been adapted from Dean Graziosi), Connects You Emotionally to your “Why” and helps you Tear Down Barriers that are holding you back from Maximizing the Effectiveness of Your Finances. Let’s walk through the 4 basics steps:

This Gaining Clarity exercise will help you create a “Culture of Progress”, one that moves you forward day by day with action and engagement. 1. UNCOVER YOUR CURRENT FINANCIAL SITUATION So let's start with your current situation – where are you with your personal finances, with your mindset, with your current habits/behaviors, and how do you feel about all of that? Although this part should be easy to figure out because it’s where you are right now, it actually might be challenging if you’ve had your head in the sand about your current situation, and you’ve just been doing the same old same old, thinking that things somehow will work themselves out. Well, if you have a desire to go someplace other than where you are, someplace new, you first need to be clear about your starting point – similar to when you're in your car and you have a GPS. For your finances, truthfully exposing your current reality is an extremely important first step. So, what IS your current reality, your pain points? Would you say any of the following: I don’t have enough money to pay my bills. I make enough money to pay my bills, but I only pay partial payments on my credit card debt. I have student loans or car loans hanging over my head. I’m saving for a house, but it’s taking a long time. I spend more time working and worrying about finances than spending time with my family. If I had money to work on my health / body, I’d be in better shape. My marriage or relationships are suffering due to financial issues and stress. I have a dream to write a book, go to the mission field, retire early… but my current financial state isn’t what it needs to be to do those things. Don't just say, “Oh, I just want to make more money” – No! Say, “I'm behind on my mortgage and I feel like a failure”, or “I have no money in savings, and I’m afraid of what may be coming down the road”, or “I want to get out of debt and have an emergency fund in place before we start a family but we’re nowhere near that, and that is sad and frustrating”, or “I want to figure out a plan to retire early so that I can do what brings me joy and makes me feel fully alive”. I encourage you to tell yourself the truth and to dig deep and then deeper below your initial answer about your current situation and how you feel about it. This will help you determine your goals and get to a WHY that will be strong enough to propel you forward. KATALYTIC: Coming out of college/grad school, I would have said, “My husband and I have good jobs, but we’re in debt with a school loan and new car loan, and we don’t really know the best way to tackle our debt, save for a house, a family, retirement, etc. and in what order. We’re confused and just kind of wandering aimlessly, doing what we think is best.” Honestly, we didn't even know enough to say those things or to ask questions. So where are YOU right now? What is your current situation? Think about it before we move forward to our destination, which we're going to define in a moment, and let’s set our GPS to our starting point. --> Take a few minutes and start writing down words or phrases that represent where you are right now. 2. CLARIFY YOUR FINANCIAL GOALS Great! Now that you know where you are, where do you want to go? Consider… looking back one year from today, what would have made this year the best year of your financial life? If we can extract ourselves from our crazy busy lives and envision ourselves one year from now, what would that year look like? Feel like? Would you say: It's been the best year of my financial life. I got the raise. I saved for the house. I got out of debt. I have a fully-funded emergency fund. My relationships are less stressful. I started my business. I’m able to stay home with my kids. Whatever it is, it's the best year of your life. What did you accomplish? What did that year look like AND FEEL like? Many of you will get sucked into what you DON’T want out of life… so if that’s you, just jot down what you don’t want. What aren't your goals -- the opposite of your goals? I don't want the stress of my car breaking down and needing repairs that I can’t afford. I don't want the stress of letting my family down financially. I don't want to keep spending more than I make. I don't want to be in the job I’m in... Now instead of focusing your energy on the things that you don't want or on things that you’ve already been doing that don’t move you forward, let’s flip those and gain clarity on what you DO WANT, so that all your energy can go towards that future. No more dissatisfaction or complacency! You've got to be focused in the right direction with clarity, intentionality, and determination. Stop wandering aimlessly. Spend time really thinking and reflecting - don’t allow yourself to get derailed. So, what DO you want?

The clearer you are on your values / your goals / your mission, the more your decisions can be aligned with those and drive what you choose to do, buy, say, and what you say “Yes” or “No” to… So with this step, what I want to do is help you define your hopeful future and how to move towards it, so that you can avoid all the things that aren't building your finances and your life. Where is it that you want to go -- so you know where to put all of your energy, set your course on your GPS for the direction towards that hopeful future. Again, looking back one year from now on your best financial year – what does it look like? How have you altered your financial life to reduce stress, plan for the future, live life fully with your family? Have you cut your expenses or sold your truck? Have you stuck to your budget and taken control of your finances so that you’re living within your means? Where are you with your job or your business? Have you gotten a raise or started a new side hustle? Have you started flipping houses? Have you saved a chunk toward retirement? And this isn’t just about finances -- How are your family/friend/work relationships? Where are you with your relationship with God? How are you physically and health-wise? What kind of impact have you had on your community / the world? Have you learned how to say NO based on your values & vision. Have you stopped looking at Facebook or Instagram and thinking that everyone’s life is better, more fun, more glamorous? KATALYTIC: For me and my husband, starting from where we were, our first best financial year included:

Whatever it is for you, one year from now looking back over your best year of finances/life – what does it look like?

And just like that -- that's where you want to go. Those are your goals, so now you can start saying no to everything that doesn’t align with your vision/your goals. Well done! 3. IDENTIFY YOUR MOTIVATION (your “Why”) AND ACT ON IT Now, if you know where you are and you know where you want to go, WHY do you want to put in the time and effort, and maybe even sacrifice, to do what needs to be done to meet your goals? Why is it important that you get out of debt, double your income, get an emergency fund, provide for your family, have less financial stress, save for retirement? My hope for you is that you can work through this step and come up with a powerful WHY to keep you motivated to reach the next level! This is extremely important – you don’t want to skip this! You might say, “I want to get out of debt.” That's great, but why do you really want that? Is it for the significance? Is it because your parents were always arguing about money when you were a kid and you don’t want that kind of environment for your kids? Or were you never able to take a vacation as a kid and you want to be able to offer that to your family? Do you want to have more money for retirement so you could be secure? Do you want to give more money to charity to help others? Do you want to rekindle the relationship with your husband/wife? Do you want to find time to be with your grandchildren? Do you want to travel the world? Do you want to get a second house? Do you want to stop running on a treadmill your whole life. Why, why, and why? I don't know what it is, but I promise you it's deeper. I want you to dig into your heart and your emotions. Get out of your head and go from your heart. There is a deeper “why” than you're even thinking of. If you tell me, “I want to get out of debt”. Why? “so that my income isn’t going to pay interest to the banks”. Okay, but so what? Why is that important? “Cuz’ I want to be financially secure enough that I can be a stay-at-home mom with my kids, and with no debt I’d be able to leave my job and do that.” Okay, now we’re getting somewhere! Are you getting to an emotional place? I think you are, but if not, you’re not digging deep enough.

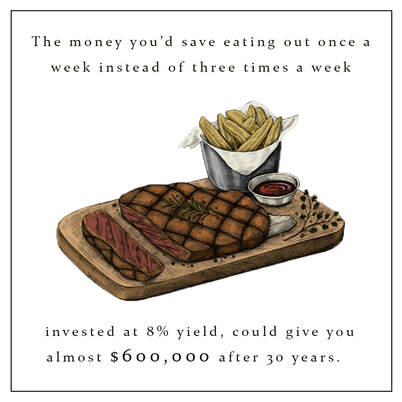

4. ANCHOR YOUR "WHY" Lastly, you’re going to anchor your WHY strongly within yourself so that it’s full of life, passion, fire, and hustle. You’ll do this through visualization. I want you to spend 30 seconds with the goals you just listed and your WHY firmly set in your heart, and close your eyes and visualize what it’s going to look like in your life when you’ve achieved your financial goals (and/or life goals) this year. How does it feel to have no debt? How does it feel to see that balance in your emergency fund account? How does it feel to be able to write that check to pay off your car with cash in your bank account that you earned? Or to take your kids on a vacation with cash that you set aside? Or put a down payment on a house you’ve always dreamt of? Or to be able to quit your job and start that business you always wanted to start? How does it feel? It feels AMAZING; that’s how it feels. I want you to just savor that and let that anchor you, because visualization is reprogramming your brain to see the evidence that you are, in fact, capable, confident, and can do this. If you want to use the powerful life that God gave you, do not let fear of failure or any self-doubt stand in your way! Instead, I encourage you to spend 30 seconds a day visualizing your future reality and all that you’re capable of. You can do this! This will keep the life and passion in your WHY and will Tear Down the Barriers holding you back from reaching that Next Level! Personal Finance Katalyst The mindset and capabilities that you’ve had in the past have led you to where you are now, but this is NOT where you’re going to stay. With clarity, you now know what your current situation is, you know where you want to go, you’ve gotten to the heart and soul of WHY this is important to you, and you know how to anchor your WHY in order to stay motivated to do the hard work. Finally, you are ready to start attacking your financial situation with purpose so that you can move toward the Future that you wrote down for yourself; your top 3-5 goals. I will provide you with knowledge and capabilities to get there and will continue to encourage and cheer you on, so now you just need to engage, do your best, make course corrections when needed, and keep moving towards your hopeful financial future. You’ve got this! SCHEDULE A FREE 30 Minute COACHING CALL. As a certified Personal Finance Coach, I'd love to help you amplify your personal financial effectiveness!  I WAS INTRIGUED by the title of an article "The Road to Riches is this Simple -- Drive a crappy car". The article's conclusion is that it's the big financial decisions, not the little ones, that will determine whether you win with personal finances. I don't entirely agree. Yes, buying an expensive car/truck doesn't make financial sense when you're still getting out of debt, building your emergency fund, and stashing all you can for college/retirement. The money saved by purchasing a $15k car instead of a $40k car could be used to do any of the things I just mentioned with debt-elimination, emergency funding, and investing. However, even the little things CAN make a big difference. Consider these two examples: 1) switching from $6 coffee 5 days a week to 1 day a week and making coffee at home 4 days/wk would save you $20 a week or $80/month. Using an online investment calculator, you can see that by investing that $80/month from age 30 to 60 with a yield of 6% would give you $80,000 when you're 60! That's pretty good for just making that small change. 2) Instead of eating dinner out 3 times a week at $50 a pop, cut it back to 1 time a week. By investing the savings of $100/wk or $400/month from age 30 to 60 at a low 6%, would give you $257,000! At 8% yield, you would have almost $600,000! What?! That's amazing! With the basics I've just shown you, how is it that so many people have next to nothing saved for retirement or a medical emergency? How are they going to survive? Before you start investing, consider applying those small (and large) savings toward your debt and emergency fund, but you can see how small changes can yield BIG results in investing. But t's all about priorities, mindset, and action -- you actually need to be investing the money that you're saving if you want to see those results. And, yes, you may not have 30 years, but I recommend starting now with the time you've got and letting all your younger friends/kids know about this so they start as early as possible! Small adjustments now, as well as large ones like buying a financially responsible car, as the article says, will give you more fuel toward your financial goals, so that you can not just survive but thrive with a financially hopeful future. What small changes can YOU make to invest in your financial future? Bottom line is that YOU are in control of your finances, and YOU get to decide not just how you want to live now but how you want to live later. What are your priorities and your mindset on this? Because YOU get to make the decisions for YOUR life now and for your future. Disclaimer: This blog post provides personal finance educational information, and it is not intended to provide legal, financial, or tax advice.

|

AuthorAs a certified Personal Finance coach (and homeschooler of 15 years), Kathleen has worked with people of all ages, but her passion is to help kids/teens/young adults take control of their finances early, learn entrepreneurial skills, generate multiple income streams, and get on a path to Financial Hope & Freedom so they can live into their passions and purpose. (Free Webinar on how to Empower Money Smart Kids with Financial Literacy & Entrepreneurial Skills) Archives

January 2023

Categories

All

|

Copyright 2023 by Katalytic, LLC

RSS Feed

RSS Feed