|

If you followed my Holiday Saving blog post from last year, you should be in great shape for holiday spending this year. But with COVID crushing so many financially, perhaps your Holiday spending fund got pilfered just so you could make ends meet.

Here are 5 tips to help give gifts for the holidays without going into debt (SAY NO TO DEBT!) 1. DIY GIFTS: I’m going to start with the no or very low cost gift ideas. If you’re like me, you love a great hand-written note. And if the card has been hand designed, even better. Remember that no one wants you to spend money you don’t have to please them. Break out of the “people pleaser” mindset. On the flip side, no one wants to see you showing up in all new clothes and then say you couldn’t get them a gift. If you really have no funds, use your creativity and ingenuity to brainstorm low or no cost gifts. Not as a cop out, but as a true gift. Use Facebook marketplace or freecycle to upscale something. Brainstorm with your friends – maybe you can help each other with DIY gifts. And if nothing else, a great hand-written note/poem may be the best gift of all. 2. BUDGET for 8 WEEKS: If you have the means, I suggest budgeting over October & November (maybe into December) for the holidays… that’s 8 weeks to save. If you can save $100 a week, you’d have $800 for the holidays. Can you do that? If you don’t need that much or you can’t save that much, then scale back. Even $50 a week (or $100 every 2 weeks) will yield $400. 3. WRITE IT DOWN: Know what you’re going to spend your money on – have a plan. If you have $500, how much is going towards gifts, food, travel, décor, charitable giving? Be specific. If you have 5 people you will be purchasing for, name them and write an amount next to their name (within your budget) and then stick to that. This plan will help keep you from going into debt. 4. USE APPS & COUPONS: Search for promos, coupons, sales. There are even apps to help you find deals (Honey) and give cash back when you shop online. to find deals when shopping online like Ibotta, Ebates/Rakuten, Shopkick, Wkibuy and Mr. Rebates. 5. “LOCK UP” CREDIT CARD: Use your debit card to shop online or at in-person stores. Could even use CASH if you’re shopping in-person. I know it’s a novel concept! Either way you’ll be more likely to stick to your budget and to not start adding things for yourself or things you don’t really need. Here’s to you as you prepare your hearts for the holiday season coming soon.  "Got Budget?” If you do, then you know exactly where your money goes each month, but if not, this post will share some insight into the age-old question: Where DOES all of my money go? According to the United States Bureau of Labor and Statistics, the average annual income and the average annual personal expenditures in the United States for 2017 and 2018 were as follows:

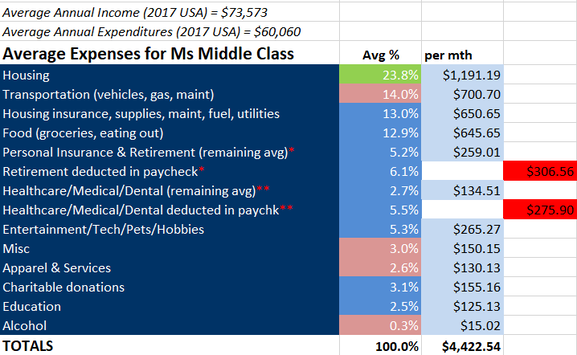

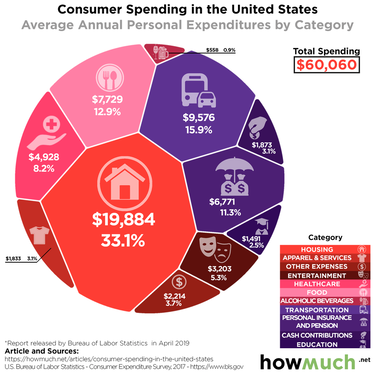

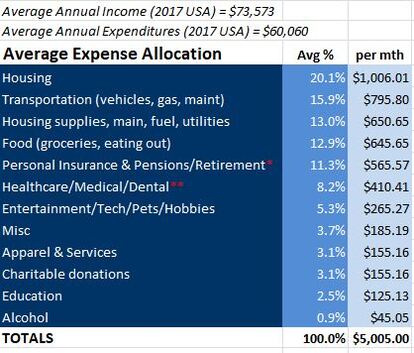

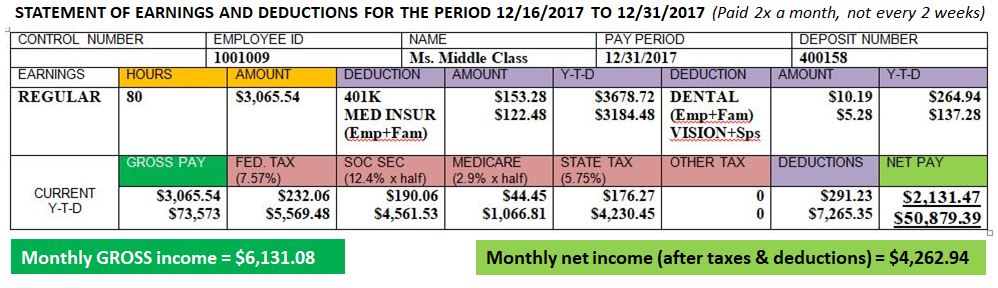

Sounds pretty good, right? Well, read on to see how it all turns out for Ms Middle Class and her family. For our example, we’re going to consider the 2017 data, because the graphic below from howmuch.net is available for that year but not for 2018. Based on the allocations of the 2017 average annual expenditures of $60,060, the monthly allocation would total $5,005 shown in the table below. The real view into this information and "where the money goes" happens when we look at a "real" example. Let's use this sample paystub below for our earner called Ms. Middle Class. The paystub represents the last paycheck for the year, so it not only includes information about the last pay period but also the totals for the year. This person gets paid twice a month, so after withholding taxes (married, filing jointly) and deductions (health and retirement), their monthly net income is $4,262.94. Using the 2017 US statistical data percentages & amounts from above, we've updated the allocation table to be more specific for Ms. Middle Class. Because she deducted money for retirement and for medical/dental/vision insurance from her pay already, you’ll see in her allocations here that those amounts (in red) are taken out so that they're not "expensed" twice. Also, since her housing costs are higher than the average, we’ve adjusted the percentages (green = increase and pink = decrease), while still keeping 2017 average expense allocations at 100%.  As I’m writing this, I’m actually doing the calculations, and I knew it was going to be close, but I was hoping that she wouldn’t be in the red! Unfortunately, you may have noticed that her monthly net pay is lower than her monthly expenses.

I’m actually feeling a little nauseous from the surprise/shock, and it’s not even real… but for so many, it IS real. Have you ever been there? Just hoping that there’s not “more month than money”? Don’t lose hope! There are things that Ms. Middle Class can do to get things back on track. But before reading further, what ideas do you have for her so that she at least balances out to zero? Without knowing her family's situation and what their current lifestyle and detailed expenses are, it's difficult to make personalized recommendations, which is what a Personal Finance coach does. Recommendations given to the family would be customized for them and their situation. In this sample case and for anyone who has “more month than money”, I always recommend 3 basic things:

Without knowing specifics about Ms. Middle Class and her family, here are some things I would suggest based on what I could see from her numbers above:

Just by doing the things mentioned above, this family could recoup the $160 that they need to break even, which definitely takes some of the stress off, BUT THERE ARE STILL MANY THINGS THAT CAN BE DONE with regard to increasing income so that they could make real forward progress. And that's the point, right?! Bottom line is, if you don't know where you're money is going each week/month/year, then you're losing ground. You CAN get back on track with some planning, focus, and determination. First thing is getting a budget together and allowing it to guide your spending. Please know that YOU are in control (or you and your spouse). This is not a straight-jacket. You create the budget with freedom and creativity based on the income and expenses you are living with. This is often eye-opening! What will YOU be able to do with a budget?

A personal finance coach can help fasttrack you to understanding what steps to take and in what order to get things moving in a forward direction. If you’d like to discuss your own situation, please reach out to me for a complimentary 30 minute consultation. References: https://www.bls.gov/news.release/cesan.nr0.htm https://howmuch.net/articles/consumer-spending-in-the-united-states If you'd like a copy of my SIMPLE BUDGET, contact me here and write "Simple Budget" in the Comment section of that form, and I'll email it to you. |

AuthorAs a certified Personal Finance coach (and homeschooler of 15 years), Kathleen has worked with people of all ages, but her passion is to help kids/teens/young adults take control of their finances early, learn entrepreneurial skills, generate multiple income streams, and get on a path to Financial Hope & Freedom so they can live into their passions and purpose. (Free Webinar on how to Empower Money Smart Kids with Financial Literacy & Entrepreneurial Skills) Archives

January 2023

Categories

All

|

Copyright 2023 by Katalytic, LLC

RSS Feed

RSS Feed